Happy MLK Day!

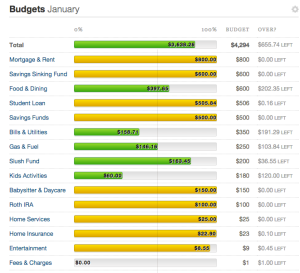

On a totally un-related-to-MLK note, I wanted to do a quick post to “check-in” on our January budget. I think it’s wise for anyone to check in on their finances at least twice a month – but I check in every day, honestly. (I love surprises, but not financial ones – unless we’re talking about how big our tax refund is!)

Note: We use Mint.com to track our finances.

The Woohoo! Category includes:

- Not over-budget in ANY category yet!

- Got a reimbursement from H’s trip back in November (but only a partial one – they only covered the gas for the trip – shoot!)

- I love, love, LOVE having the $200 slush budget line – all of those pesky transactions that never seem to fit anywhere (post office, random little purchases for household needs, a radon detector, even a new card table & chairs set so we can have a kids’ table when we host gatherings!) now have a place and I feel so much better with them organized.

- It looks like we’ve budgeted well for our gas for the month – the date line and the budget line match up perfectly!

- I put aside $110.01 in our Student Loan Debt Eradication fund early on.

In the Whoops! Category:

- We haven’t get received the reimbursement from the return that H sent back at the beginning of the month. That meant we had to pay off the entire credit card bill so that we wouldn’t get slapped with a finance charge when our bill came due a few days ago. This means we now have less in our checking account than we need for the remainder of our budget.

- Any extra money we got this month (including the reimbursement from the November trip) has gone to just padding our checking account, because we’re off by so much. This has actually helped us close the gap by almost $400, which is helpful. We may only need a little more from the emergency fund (alternately, if the refund comes through this month, we’ll also be okay).

- It looks like we’re creeping up a bit fast on our food budget, which means we may not have any left over to put aside for Student Loan Debt Eradication. We ran out of a couple of staples and had to make some quick runs to the more expensive grocery store nearby rather than the one that we like to go to (an hour away, when we take L for her ballet lessons on Saturdays). We also hosted a dinner for some friends, and while it was just pasta (and the friends brought an appetizer and salad), we did buy sausage for the sauce (an indulgence we don’t usually buy for our own pasta). We’re also going to a casual potluck this afternoon, so we bought a couple extra things to make our specialty potluck dish (bacon-wrapped dates!). I will say that knowing that these expenses would be happening, H was very careful when shopping and didn’t pick up anything that wasn’t on the list (though there was that $5 bread that H thought was a good idea – he didn’t know that there was cheaper bread available!).

I’m hoping that by the end of this coming week, we’ll have our W-2s in hand and be able to continue working on our taxes. I’ve already entered as much as I can (we use TurboTax) but I can’t get even get a rough estimate of our return until we enter our income.

How’s the first month of 2015 going for you all, financially-speaking? I’m disappointed that this month won’t be one of great Debt Eradication, but it was the last month of funding our Travel savings, so I’m looking forward to February!

Congrats for being on track and having a completely funded travel savings! 🙂 I hope you get the pesky reimbursement back soon and your W-2’s… we are patiently (not so patiently) waiting for ours! This is our first full year of one-income, but probably not as many deductions… so I’m a little nervous and have no idea what to expect. Although, I’m quite confident we should’t owe anything. 🙂

LikeLiked by 1 person

Not owing on your taxes is the best! I feel for our PF blogger brethren who are freelancers and having to pay their taxes…. eep!

LikeLike