Welcome!

This year, I’m going to try to keep my monthly recap posts a bit more succinct, so here goes!

January 2016 Budget Recap – How We Did

We went over budget, and the categories were the usual suspects: restaurants (well, usually it’s food altogether, but I’m happy to see that we stayed under a reasonable amount for groceries this time around) and the slush fund (a curling iron, library fine, shipping costs for a box for my parents, new slippers, parking). The other areas were a $10 I forgot we would need for an activity for our daughter and our higher-than-normal electric bill, given then cold weather recently (brrrr!).

Month-to-Month Progress:

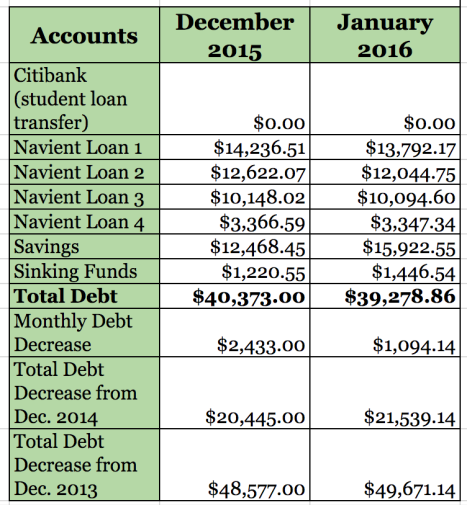

There wasn’t a huge change this month – that $1000+ decrease reflects our regular monthly payment plus our snowflaking. It’s better than I expected it would be, but it wasn’t easy to pull it together this month!

How far we have come:

Okay, at least that number is pretty gratifying! Almost $50,000 of debt paid off in a little over two years! (To clarify, that amount includes debts that are no longer listed above, as they’ve been at a 0 balance for a while, such as our car payment and other credit cards, as well as another student loan that has been paid off.)

January 2016 Snowflaking

As a reminder, our goal for each month is to snowflake at least $239 to pay off H’s student loans by February 2017. (For more on our goals, see this.)

We snowflaked an extra student loan payment of $281.99 this month, as you saw in our January 2016 Snowflaking Report. (For more details, please see that post.)

Things are already looking great for February’s Snowflaking, so I’m looking forward to sharing that when I send the next payment!

January 2016 Consignment

- $64.66

I suspect this number will not be so high in the coming months, as I haven’t given them as much stuff to sell recently, so we will see what happens….

Other Money Details

- We have saved another $1504 for this month, which gets us to our goal in our Savings Account! (In case H’s job situation doesn’t work out, we want to have a comfortable amount of money in our emergency fund – we should know something before May 1st. Please send us good vibes….)

- Next month will begin our more robust repayment of our loans, as that $1504 we’ve budgeted for savings for January and February will now start going straight to extra student loan payments!

- I completed our taxes last night, and I was disappointed (again) by the amount we’re (not) getting back. It will actually be around $1500 (knock wood), but I was secretly hoping for more. I did not include any possible refund in our 2016 Goals, though, so anything is icing in the cake.

- I am still hoping against hope (and doing all I can to make it happen) that we can reach our stretch goal and have all of our loans paid off in February 2017, but while it still seems feasible now, I think the next few months will be telling in whether or not we can accomplish it. We could always hope for a windfall, right?

Your blog is greatness! 🙂 Definitely inspiring me to figure out my goals and smart snowflaking!

LikeLike